- By

- 0 Comments

In this blog post, we’re embarking on an in-depth exploration of Infinite Banking, providing a comprehensive guide to its mechanics, benefits, drawbacks, and financial requirements. Let’s delve deep into Infinite Banking and explore whether it’s your right strategy.

Understanding Infinite Banking: Mechanics and Operation

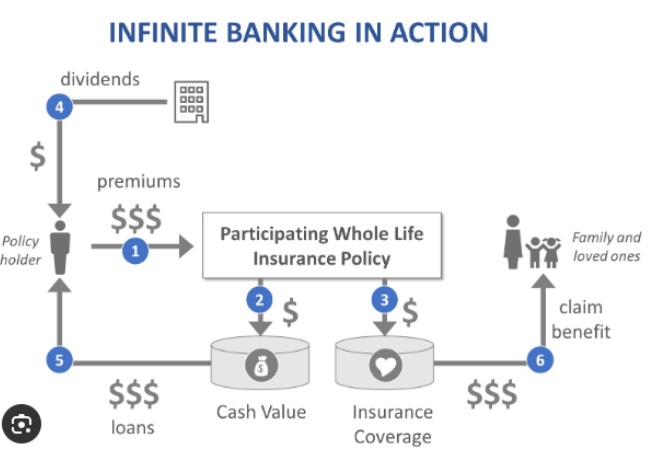

At its core, Infinite Banking revolves around using whole life insurance policies to accumulate wealth and secure financial autonomy. The process involves creating a strategically structured whole-life policy with mutual insurance companies and overfunding into this policy, increasing cash values over time via the magic of compounding and tax-free growth. This approach is applied to generate guaranteed returns and additional dividends while retaining control over one’s finances.

The mechanics of Infinite Banking are rooted in the concept of leveraging the cash value of these insurance policies. By consistently overfunding the policy through premiums and additional contributions, individuals can build up a reserve of cash as his/her own private bank, that can be accessed through leverage or cash withdrawal. These loans allow for continued cash value growth while providing liquidity for various financial needs.

Is Infinite Banking a Good Idea? Assessing the Pros and Cons

While Infinite Banking offers several potential benefits, weighing them against the associated drawbacks is essential to determine if it’s a suitable strategy for your financial goals.

Pros:

- Steady Growth: Infinite Banking offers the potential for steady growth of cash values over time,

- Liquidity: Policyholders can access funds through policy loans, offering flexibility in managing financial needs.

- Control: Infinite Banking allows individuals to retain control over their finances, avoiding reliance on traditional lenders.

- Hedge against Recession: Being created at a mutual insurance company that existed for over 150+ years and never lost money, even during the great depression, this strategy provides a hedge against market cycles, especially recession

Cons:

- Cost: Whole life insurance policies can be more expensive than term life insurance, with higher premiums and fees, but provide a non-vanishing death benefit unlike term

- Limitations: Withdraw/Premature Surrenders of the policy can result in significant penalties, limiting flexibility, a withdrawal or loan is recommended instead

- Returns: The returns generated through Infinite Banking are often expected and compared to investments, however, it should be noted that this is a savings strategy and replacing Bank or Bond portfolio in your financial structure, with safety and security tied to your savings as well as life

- Age and Health: Since the private banking system uses underlying insurance policies to overfund and use as a bank, the age and health of the individual are under consideration. While good health would be optimal, an alternate strategy can be applied if insurability is a challenge, ask us how

How Much Do You Need to Start Infinite Banking?

The financial requirements for starting Infinite Banking vary depending on individual circumstances and financial goals.

- Policy Premiums: Policyholders must be able to afford the premiums associated with a whole life insurance policy. These premiums can be created based on an individual’s ability to sustain the payment, Additional Contributions: Additional contributions or overfunding your policy is the core of infinite banking, individuals can overfund and maximize returns value by purchasing paid-up additions. These additional contributions can enhance the growth potential of the policy

In conclusion, Infinite Banking represents a unique approach to wealth accumulation, offering stability, control, and flexibility for individuals seeking an alternative to traditional investment strategies. Negative perceptions about Life Insurance often deter individuals from holistically reviewing how Infinite Banking can add security and safety to their financial structure. However, it’s essential to carefully structure and implement this strategy property based on your goals and understand this financial product carefully to align with your financial goals and objectives.

We are passionate about explaining this strategy, educating with case studies, and creating a structure based on clients’ goals and objectives. This out-of-the-box strategy could be overwhelming, and we take pride in simplifying it for you. Get in touch with us today to move forward in your journey.

Stay tuned for more insights and discussions on practical wealth-building strategies!

Warm regards,