- By

- 0 Comments

A Data-Driven Analysis.

The rising price of real estate all over the country is one of the biggest challenges to buying a house in the current economic climate. In 2022, rate hikes by the Feds and fear of Recession have made buyers even more scared or unable to buy houses. Existing home sales in the US tumbled 5.9% to a seasonally adjusted annual rate of 4.43 million in October of 2022, the lowest since December of 2011 except for a very brief fall at the beginning of the pandemic, and compared to the market forecasts of 4.38 million

After peaking at 69% in 2004, homeownership fell every year until 2016, when it was 64.3% — the lowest level since Census Bureau started keeping track in 1984. The rate rebounded during Donald Trump’s presidency, hitting 66% in 2020. In 2021, with the impact of work from the home environment during the pandemic and historic low rates, the housing market was desperately in short supply and seeing month-over-month price increases greater than they were in the frenzied market of 2006. As soon as we saw the Feds pushing for several rate hikes, with fear of recession looming, the homeownership falling, and so as the housing market. The rates of homeownership in the U.S. began at 65.3% in the first quarter of the year 2020, it ended at 65.5% in the fourth quarter of the year 2021. The stats show us that the rates of homeownership in the last quarter of both years were indifferent.

The Current State of Renting in America

On the other hand, there are 21.4 million multifamily housing apartments all over the nation with over 39 million residents occupying them and they contribute over 175 billion US dollars to the local economy, with 58 billion US dollars in property taxes.

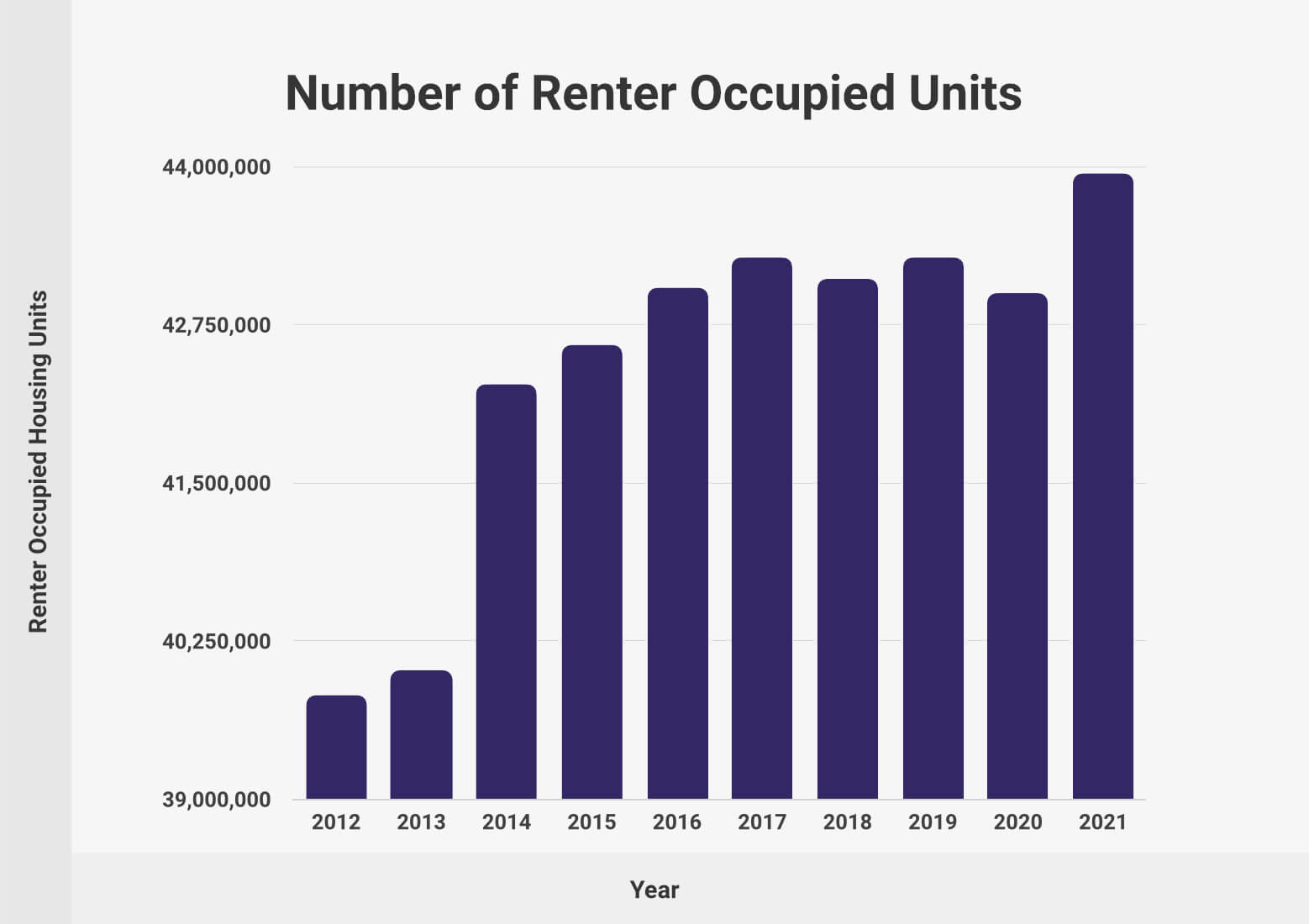

The demand for multifamily housing is increasing in America while the supply of the same is not able to keep up. However, the above statement can be justified by the facts providing that in 2021 almost 37% of renters reside in apartments. Housing units occupied by renters were about 44.1 million and 109 million Americans live in rental housing. There was a demand for 328K new apartments with just under 300K apartments being built and the occupancy rates in 2019 were also at an all-time high at 96.1 percent. This combined with rent growth of 3.2 percent in the same year makes investing in multifamily housing an exceptionally lucrative opportunity.

Admittedly, these rates fell a bit in 2020 with the global pandemic affecting all industries, but they were still quite stellar at a 95.8 percent occupancy rate and a 2.6 percent growth in rent. For the year 2021, U.S. growth of rent declined to 10.9% on a year-over-year basis. Moreover, it rose to 6.6% on a year-to-date basis. This year has a 96% of occupancy rate for straight five months till July.

1. Reason for Demand Vs Supply Gap

Here are some of the major reasons that state the lag of supply behind demand.

- Dropping of units- The primary factor is the loss of units. Every year units are off from the markets because of destruction, demolition, etc. irrespective of whatever the reason it impacts the supply.

- Ascending rate of interest- With the increase in interest rates, it is quite expensive to borrow money. Thus, the builders are affected by this and rely upon the debt to finance their projects. Therefore, the supply is directly affected by this.

- High costs- The cost of resources used for construction is increasing rapidly like the labor and land costs which impact the building of new apartments. The inflation in the prices leads to an impact on the supply.

- Focus on the supply of High-End Luxury Properties- The high cost of construction materials makes it difficult to build and invest all of this in anything other than high-end properties. For this reason, it is predictable that the new construction will slow down affecting the supply cycle or chain.

The demand has been outpacing the supply consistently for over a decade, creating a huge hole in the housing need, especially for America’s workforce.

2. Baby Boomers

The American dream shifting from house buying to financial freedom is affecting a lot of things. Baby boomers are downsizing big time. The main reason for this is because of the recession in 2008 due to which they lost most of their money and had to move out of their homes towards rent places to sustain a lifestyle as they could not afford to maintain big houses.

This results in a decline in ownership within the baby boomer population along with financial sustainability

3. Millennial and Gen Z Priorities

In real estate, the perspective of both these generations is quite similar. There is a shift in the housing market because of millennials, as they account for most of the demographic of homebuyers which is why Gen Z has less buying power. Millennials are open to multifamily housing options, as their first home. Owning a home used to be an American Dream, but with this generation ‘Nomadic Lifestyle’ is becoming a priority. With this change in the American Dream definition, millennials want freedom in jobs, they want to work from different cities, change their jobs after 2-3 years, and want to work from anywhere and still be efficient, to have a digital nomadic lifestyle. The main reason is the global pandemic in 2020 that brought a major shift in lifestyles. Millennials are moving towards an urban lifestyle with change in priorities and in many cases, with increasing housing and interest rates, affordability becoming an issue.

Whereas, with Gen Z still graduating, they feel the financial load of inflation combined with the high cost of living. So, most Gen Z is renting, and trying to save up to buy homes in the future. These multiple factors are leading Americans to seek financial freedom instead of home ownership.

The American Dream

While it is true that the dream of being a homeowner, a long-time core idea of the American Dream, is slipping out of reach for low- and moderate-income Americans, it would not be far from the truth to say that the American Dream itself is changing with more and more people working towards freedom, whether it is financial freedom, freedom to jump from job to job, or city to city, or travel and work from anywhere, making the earth a flat playground.

The new dream is about financial freedom, choice, ease of life, and the freedom to pursue whatever gives you happiness without being tied to a city, place, or especially a house.

The demand for multifamily/apartment living as we see is creeping up, indicated by a record of a 13.5% increase in rent growth in 2021 as stated by Yardi Matrix data. If you are wondering how you can tap into this growing demand sector, with 8 digits worth multi-million real estate, with the money you have, it is a possibility via a syndication model. We at Think Outside The Stocks not only bring you data-driven education to make you understand this asset class and the syndication model, but we also bring you vetted investments from time to time so that you can review and participate in this growth, that too completely passively.

If that sounds like you and you’re wondering where to go, learn the hassle-free way of investing in multifamily real estate with the money you have.

Interested in learning more?

Access free education Multifamily Syndication 101

Interested in Investing with us: