- By

- 0 Comments

After a decade of steady economic growth, the world is once again facing the possibility of a recession in 2023. Although the exact cause of this downturn is still unknown, many experts point to several factors contributing to the current economic climate. Despite these challenges, many analysts believe this recession will be a “soft landing” rather than a catastrophic crash.

First, let’s talk about how we got here for the 2023 Recession:

- The COVID-19 pandemic disrupted global supply chains, caused widespread job loss and decreased consumer spending, and had a significant impact on the global economy.

- Post-pandemic, the stimulus from the government inflated savings in households. As they stayed home, saving on travel further, supply deficiency and stay-at-home work environment increased household consumption, pushing inflation at a decade-high rate.

- In 2022 inflation started eating into the household savings, reducing its power. With a lack of real income growth Vs inflation, households dipped into excess savings.

- The result: It lowered consumer confidence. Households will be more conservative in reducing consumption.

- Feds had to step in to curb the multi-decade high inflation and raised interest rates. We have seen the high rates before, but the pace at which they went for it has a huge impact. Feds raised rates seven times in 2022, including four times in super-sized 0.75 percentage point increments to bring down inflation.

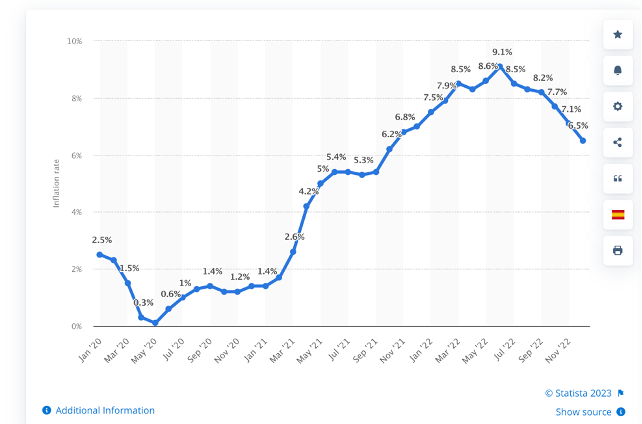

While inflation has shown a significant downfall from its peak of 9%, Feds are expected to raise rates further, to curb the inflation to 2%.

How about interest rates

Feds raised the rates one more time in February 2023 at a quarter point, but at least One Rate Cut is expected on the horizon in 2023.

Why might it turn out to be a Soft Landing?

There are several factors contributing to a soft landing in 2023.

- Sooner-than-expected reopening of China’s economy, which has helped to restore stability to the global economy.

- With the energy crisis in Europe rooted in the Russia and Ukraine war. Europe feared freezing this winter, but a warmer than usual winter, taking the steam off the demand, has helped, thanks to climate change.

- Feds’ aggressive push on interest rates, has shown a sustained decline in US inflation, hence mitigating the impact of the recession.

- Technology in the global economy: Thanks to technology in the digital economy, many businesses were able to change their practices to adopt models suitable for the economic climate.

In conclusion, with the right policies and responses, the global economy can weather this storm and come out stronger on the other side. It is important to keep a close eye on key indicators such as inflation, interest rates, and consumer confidence, as they will provide insight into the trajectory of the global economy.