- By

- 0 Comments

Several economists and reports are forecasting a recession in the US economy, but the good news is, a softer landing is also being predicted by most. As investors and stakeholders in the commercial real estate market, it’s important to understand the potential impact of this recession.

High Inflation and high-interest rates 2023 will continue to be a challenge for Commercial Real Estate in 2023. This does not mean the waters cannot be navigated, just needs to be traded carefully.

With the environment of uncertainty, investors are cautious, and as a result, $3 Trillion waiting on the sidelines in the money market. Investors are wary of making decisions that could have long-term consequences. However, with inflation still not under control, hovering around 7%, as an investor you should also consider that the value of money in the bank accounts will erode, causing your hard-earned money to lose its buying power in near future

Commercial Real Estate Investor’s Outlook

So should CRE Investors consider the same asset classes, such as Multifamily, their top choice or pivot from the strategy and diversify into more recession-resistant assets? Let’s look.

According to CoStar’s 2023 Outlook report, the impact of the recession on Commercial Real Estate is imminent, but there is hope. Let’s understand the key factors impacting the CRE

Key Factor#1: CAP Rate Expanding

Why is the CAP rate important and how would it impact CRE values in 2023?

An increase in CAP rates means at the same operating income, property value decreases. While CAP rates change at the slow progression that nationwide single-family home price decline, it still impacts the prices to slide

Key Factor #2: CRE Lending Environment Risks

CRE Distress sales which remained steady due to forbearance and rental assistance in the last couple of years could go higher in 2023 due to multiple reasons stemming from Increased interest rate hikes. Specifically,

- High refinance risk for loans that are coming due,

- Cash Flow risks for variable/bridge loans,

- High Loan-to-value risk due to CAP rate increase (value dropping),

- Expensive rate CAP (think interest rate insurance) and increased reserves demands from lenders

The risks can be mitigated with emphasis on a RIGHT lending product based on the investment.

The impact of the recession, inflation, and interest rate hikes puts pressure on CRE, but outside megatrends are impacting some asset classes that need Investor attention, especially if you are looking for recession-resistant asset classes

2023 Commercial Real Estate Asset Opportunities to Watch for

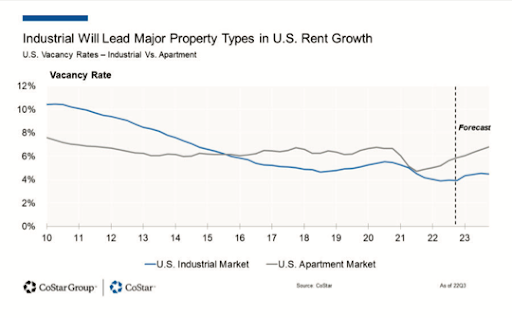

A. Skyrocketing Industrial and Warehouse CRE Demand

- Consumer Behavior:

During COVID-19 and post-pandemic, consumer behavior toppled the supply-demand balance. Retailers reacted by increasing the supply to cope with the demand. Reduced buying power due to inflation in 2022 and lower consumer confidence has now curbed this demand, pushing consumers into conservation mode.

The result: Retail inventories increase as consumption drops, big brand retailers are now forced to store their higher inventories, needing more Warehouse space

It’s astonishing to see the current gap between consumer sentiment and retail inventories below

- Industrial: Demand: Skyrockets due to Deglobalization Trend

The deglobalization phenomenon is bringing the manufacturing industry back to the USA due to several factors such as war, supply-chain issues, especially the enormous chip shortage, and the aftermath that impacted big and small corporations.

The result: According to Commercial Ledge market reports:

- Industrial demand continues to outpace supply,

- New constructions getting absorbed at a rapid pace,

- 450 million sq ft industrial space was delivered last year, setting a new industry record

See Result: Industrial national occupancy rates at 96.1% outpaced multifamily occupancy at 94%

B. Medical Office has a healthy outlook

Increasing pressure on the healthcare system in the past couple of years has pushed upward pressure on medical office demand. Medical Offices provide a steady cash flow, with long-term leases, lower turnaround, and vacancy due to complicated move-outs. Staying ahead of baby boomers, medical office demand remains steady but is tied to the market/submarket demand. However, an oversupply of medical offices will weaken this asset class in certain markets

C. Other CRE Sectors to Watch out for and consider

- Mixed-Use Demand will continue to Outperform

- The office concentration is still high but growing occupancy is concerning

- Asset Classes that continue to be historically Recession Resistant are Multifamily, Self-Storage, and Mobile Home Parks.

- Single Family: With the recession Single Family new builds, especially in Built to Rent, in the CRE category are projected to grow as well

- While fundamentals for Multifamily remain strong, the current environment calls out to trade carefully, we will discuss Multifamily in another article soon