- By

- 0 Comments

When it comes to investing in real estate and diversifying your portfolio, single-family and multifamily make the key players. One classic way that most busy professionals adopt when investing in real estate is to buy a property and lease it. Being a landlord can come in many forms. The first option is to be a landlord in single-family homes, which is an attractive option to not only generate monthly income but also save taxes. Another more lucrative option is multifamily syndications that not only save investors from the hassles of dealing with tenants, toilets, and trash, but also provide massive tax benefits that hugely surpass the tax benefits obtained with single-family.

How Does Tax Saving Work in Real Estate?

In the words of Robert T. Kiyosaki, “It is not how much money you make, but how much money you keep.” In real estate investing, this typically means that even if cash flow is important, what makes this investment more lucrative is the benefit of sheltering this cash flow with numerous tax-saving options. You can greatly increase the potential profitability of your multifamily assets by being aware of the tax benefits that come with these investments and leveraging them to their full capacity.

Multiple tax benefits can be enjoyed with real estate investing and we will be critically analyzing the same in today’s blog. We will deep dive into how real estate investing offers tax savings to its investors and how multifamily tax benefits hugely surpass other real estate investments.

Depreciation–What is Depreciation?

Depreciation tax benefit recognizes that real estate is a physical property that wears down over time and loses value.

To account for the cost spent on maintenance and renovation of the property, the IRS allows property holders to write off this value from their taxable income. Depreciation is accounted as a paper loss (not actual loss) for the non-cash expense in the tax bill, that is it reduces taxable income, but not the amount of cash available for distribution.

The curious thing is that in reality, real estate appreciates over time, that is value increases and provides better returns to its investors. However, by writing off the theoretical loss in value under depreciation tax benefit, without having to practically spend that much on renovation, investors get to lower their tax burden. Interesting right?

Straight-Line Depreciation– The Simplest Form of Depreciation

Now let’s understand how the depreciation, often called straight-line depreciation, is calculated, to understand it better.

Straight-line depreciation assumes that the value of property depreciates at a constant rate and allows to spread the depreciation value uniformly over all the useful life (years house could be used) of the property.

Calculating Straight-Line Depreciation

Two important elements while calculating depreciation amount are cost basis and useful life.

- The cost basis is the total amount spent to acquire the asset.

The cost basis does not include the land value, as land is considered to have an indefinite useful life, after all, it does not break down over the period of years. However, land improvements like a parking lot, driveway, sidewalks, etc are counted under depreciation consideration.

Additionally, certain closing costs can also be depreciated like

- legal fees

- transfer taxes

- utility installation fees

- recording charges.

Thus, the adjusted cost basis is obtained by subtracting land value from the property cost and adding the closing and settling costs.

2. Useful life is the expected duration over which the property depreciates.

Per the IRS rules, the useful life of

- residential real estate = 27.5 years,

- commercial real estate = 39 years.

Straight-line depreciation is calculated as Cost Basis / Useful Life

Let us understand this practically by taking examples of residential single-family and multifamily properties:

A Residential single-family home worth $400,000:

- Adjusted cost basis (cost without land): $350,000

- Straight-line depreciation: $350,000/27.5 = $12,727 per year

This means if you had $15,000 cash flow from this rental,

- You can write off $12,727, and

- Your tax liability = $15,000 – $12,727.27 = $2273

A Residential multifamily property

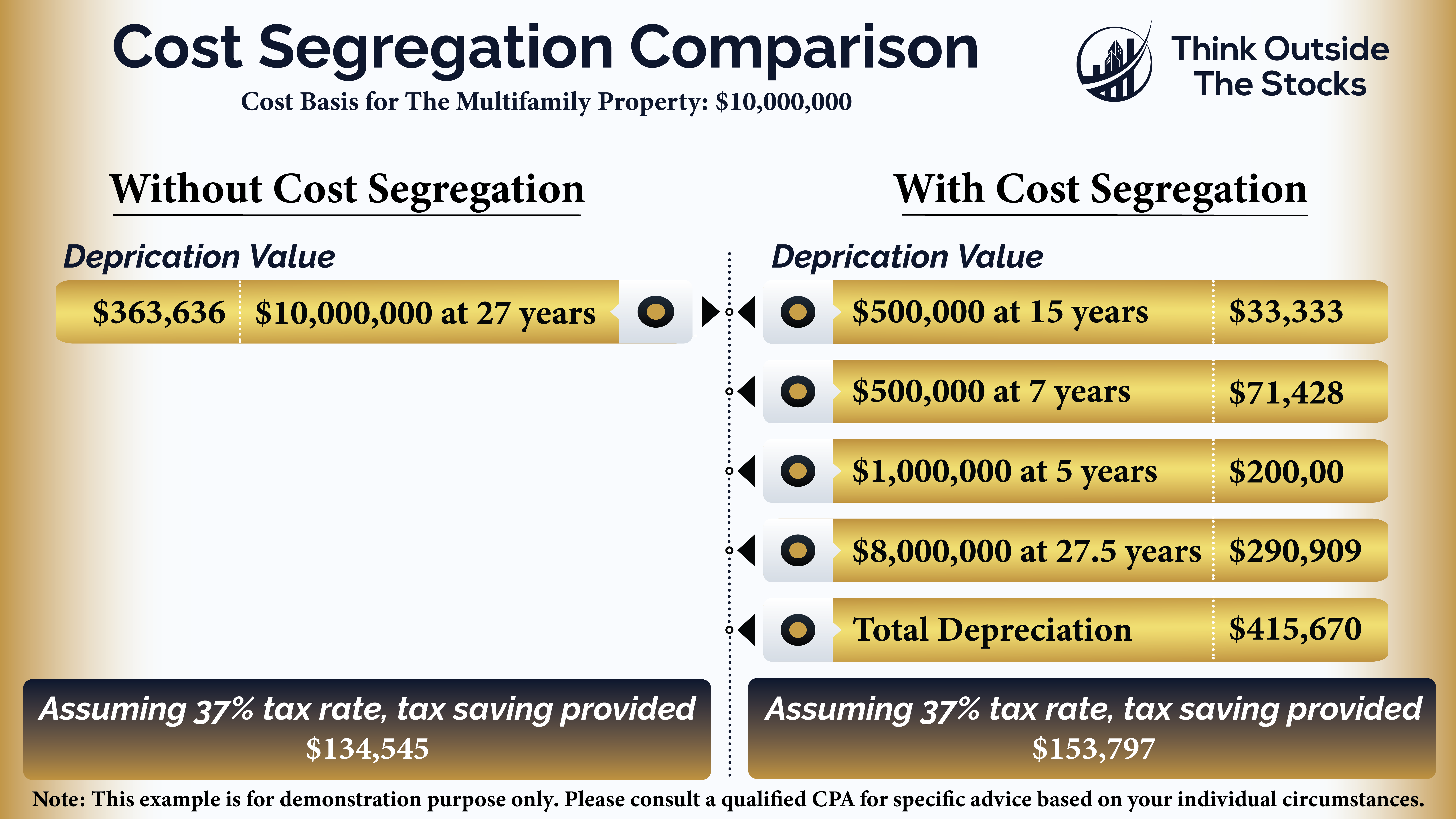

- Adjusted cost basis: $10 million,

- Straight-line depreciation: $10 million/27.5 = $363,630 per year

This means if you had $500,000 cash flow after expenses from this property,

- You can write off $363,630, and

- Your tax liability = $500,000 – $36,3630 = $136,370

As a multifamily passive investor, this write-off gets distributed back to investors, helping them get similar tax benefits.

What Makes Multifamily Investment Stand Out?

But wait!! This tax benefit does not stop there. With multifamily investing, you get two more levels of tax benefits:

- Cost segregation

- Bonus Depreciation

Let us deep dive into both these tax benefits and understand how you can exponentially increase your tax savings using them.

Cost Segregation– For Accelerated Depreciation

With cost segregation, the IRS acknowledges that not all assets of the property depreciate over the same period. Some portions of the property depreciate at a much faster rate, that is 5, 7, or 15 years.

For example,

- 5- or 7-Year Depreciating assets: Personal property, such as kitchen appliances, furniture and fixtures, carpeting, millwork, decorative lighting, and window treatments

- 15-Year Depreciating assets: Land improvements such as sidewalks, paving, parking lots

By taking stock of individual elements of a property, cost segregation accelerates depreciation leading to increased tax savings. This interesting rule helps boost tax savings further.

Multifamily Properties make an excellent candidate for Cost Segregation studies

Cost segregation studies typically employ certified engineers and tax consultants for credibility and a greater amount of tax savings. Doing cost segregation costs some dollars and time. When carrying it out for single-family properties, it is not a feasible idea considering the little to no benefit that comes out of it. As multifamily properties entail huge investments and have more potential for segregation, they reap the maximum benefits of cost segregation studies. With multiple units and the wide variation in assets, multifamily units make the best case for cost segregation studies.

Bonus Depreciation–Maximizes Cost Segregation Benefits

But wait! If you were to understand Bonus Depreciation, it would make sense why the cost segregation is even more beneficial.